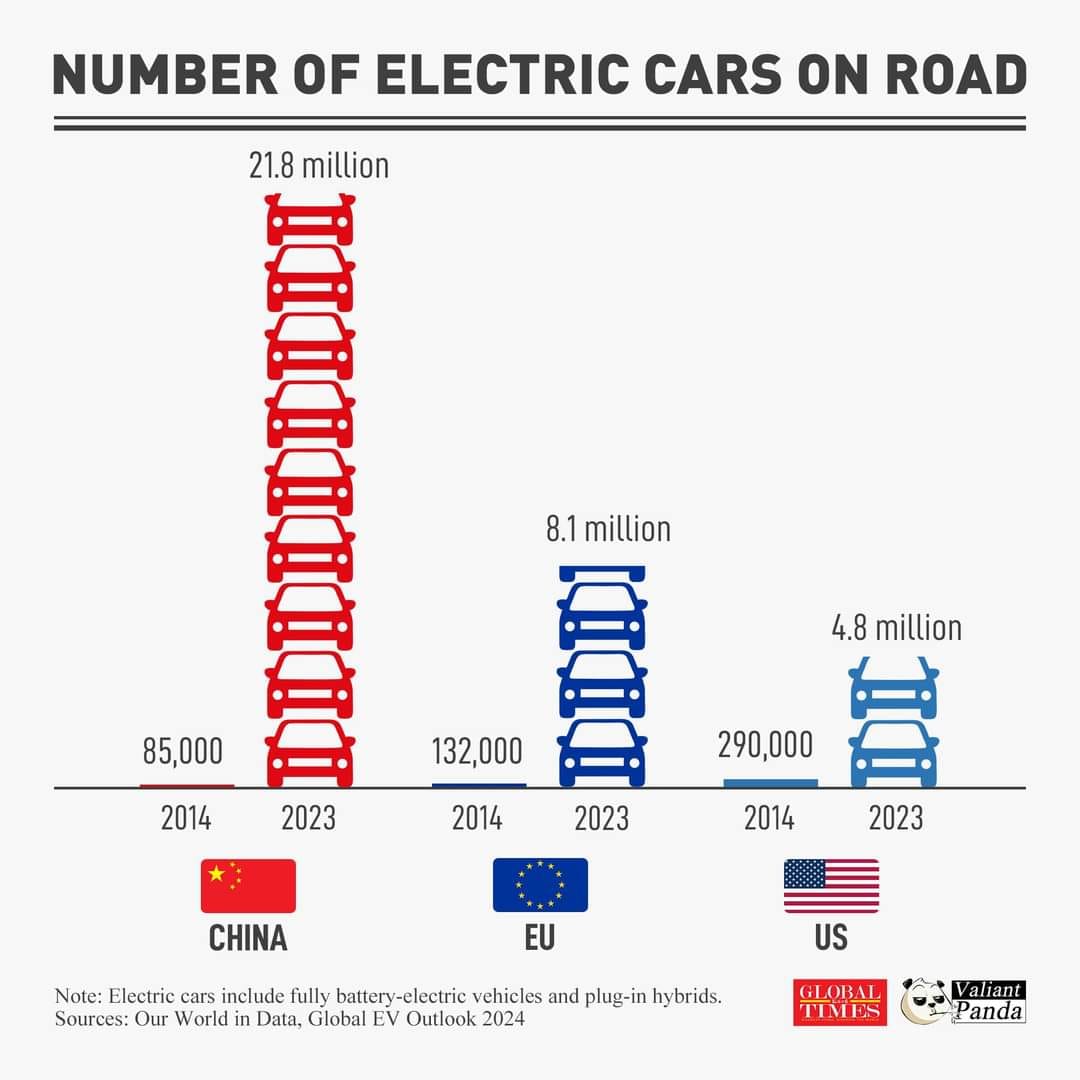

The electric vehicle (EV) market is at a pivotal moment, and China is at the forefront, accelerating past the U.S. and setting the pace for the rest of the world. With over half of the world’s EV sales occurring in China, the country is rapidly solidifying its position as the global leader in this transformative technology. This rapid growth is reshaping the automotive landscape and putting pressure on other nations, including the U.S., to keep up or risk being left behind.

China’s rise in the EV market isn’t by accident—it’s the result of deliberate policies, strategic investments, and a clear vision for the future of transportation. In 2023, nearly 60% of the world’s EV sales occurred in China, outstripping any other country by a significant margin. The Chinese government’s aggressive support for EVs, including subsidies, mandates for automakers, and investments in charging infrastructure, has propelled the nation forward. Major Chinese cities are rapidly adopting EVs as part of their efforts to combat air pollution and reduce greenhouse gas emissions, positioning the country as a leader in sustainable urban mobility.

Battery Production and Infrastructure: China’s Competitive Edge

One of China’s most significant advantages in the EV race is its control over the battery supply chain. Chinese companies dominate the global production of EV batteries, including critical components such as lithium, cobalt, and nickel. This control allows China not only to meet its own EV demand but also to supply batteries to automakers worldwide, creating a strategic economic advantage.

Furthermore, China’s extensive network of charging stations dwarfs that of the U.S. The country’s commitment to building a robust charging infrastructure has made EVs more accessible and practical for everyday use. By prioritizing infrastructure, China has effectively reduced one of the major barriers to EV adoption—range anxiety—thereby encouraging more consumers to make the switch from traditional gasoline-powered vehicles.

America’s Challenges: Playing Catch-Up

While the U.S. has made strides in EV adoption, it lags behind China in several key areas. Inconsistent policies, a fragmented charging network, and reliance on foreign battery supplies have hindered America’s ability to compete at the same level. Though major American automakers are ramping up their EV production, the U.S. is still struggling to match China’s scale and pace.

The Inflation Reduction Act and other federal initiatives aim to boost domestic EV production and battery manufacturing in the U.S., but these efforts are still in their early stages. Without significant acceleration, America risks falling further behind, potentially losing its position as a leader in automotive innovation.

The Future: A Global Shift Toward Electrification

The data is clear: the world is moving toward electrification, and China is leading the charge. However, this raises a critical question: Is the U.S. losing a race that will define the future of the automotive industry, or is China heading into another economic bubble, similar to its real estate boom and bust? With such rapid expansion, China’s EV market could face overproduction, reliance on government support, and market saturation challenges.

As we watch this EV showdown unfold, one thing is certain: the stakes are high, and the outcome will have lasting implications for global economic leadership. For more insights on the global EV market, visit Our World in Data.

Bar chart showing the rise of electric cars by region from 2014 to 2023: China (85,000 to 21.8 million), EU (132,000 to 8.1 million), US (290,000 to 4.8 million). Data sources: Global EV Outlook 2024.